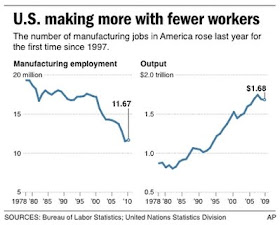

The U.S. manufacturing capability was never in the process of going away. It has continued to grow. What has gone away are manufacturing jobs. An AP article provides this graphic.

An article in The Economist provides a closer and more current view.

An SFGate article provides a concise summary of the situation in this country.

“Several trends have emerged over the decades:In spite of the media hype, the U.S. still outproduces China by 40 percent. U.S. factories produced $1.7T in goods in 2009. While China focuses on production for export, the U.S. is still its own best customer.

“America makes things that other countries can't. Today, "’Made in USA’ is more likely to be stamped on heavy equipment or the circuits that go inside other products than the TVs, toys, clothes and other items found on store shelves.”

“U.S. companies have shifted toward high-end manufacturing as the production of low-value goods moves overseas. This has resulted in lower prices for shoppers and higher profits for companies.”

“When demand slumps, all types of manufacturing jobs are lost. Some higher-end jobs - but not all - return with good times. Workers who make goods more cheaply produced overseas suffer.”

“Thirty years ago, U.S. producers made 80 percent of what the country consumed, according to the Manufacturers Alliance/MAPI, an industry trade group. Now it's around 65 percent.”The Great Recession has generated some changes in markets that are likely to be long term. According to The Economist:

“American factories still provide much of the processed food that Americans buy, everything from frozen fish sticks to cans of beer. And U.S. companies make a considerable share of the personal hygiene products like soap and shampoo, cleaning supplies, and prescription drugs that are sold in pharmacies. But many other consumer goods now come from overseas.”

“Beyond this cyclical bounce-back, though, a structural shift may also be under way. Makers of floorings, furniture and glass, all of which go into houses, were especially hard hit and have yet to start hiring again. But those that make things for businesses or customers overseas—computers, machinery, electronic equipment, heavy-duty trucks—are thriving. Cisco Systems and Intel Corporation notched up record sales last year. Caterpillar and John Deere, which makes diggers, bulldozers and farm equipment, saw sales leap.”And developing countries are to be cheered not feared.

“In its Economic Report of the President last month, Barack Obama’s Council of Economic Advisers calculated that each additional percentage point of another country’s growth boosts its imports from America by three percentage points. It thus expects emerging economies, including Mexico, to account for 71% of America’s export growth from 2009 to 2014—especially in farm products, aircraft, integrated circuits and oil- and gas-field machinery.”There are a number of factors that seem to be converging and providing hope that manufacturing in the U.S. can expand sufficiently to provide a significant number of long-term jobs.

As businesses become more efficient, time scales become shorter and product builds become more focused. Shorter build cycles, more specialty items, and rapid design changes all favor domestic production. If the price of oil remains at an elevated level, that will also shift the profitability calculus in the favor of domestic production. There is a second phase to globalization. The overseas companies that gutted some of our industries with their imported goods are now beginning to realize the advantages of building the product in the product’s market. For example, many lost automotive jobs are gradually returning, albeit in another form, via factories being built in the U.S. by our competitors.

So stay tuned! There are many pages yet to be turned in this tale.

No comments:

Post a Comment