The claim that 50% of the US population pays no income taxes has been around the block several times by now. As with most politically-charged comments it has a grain of truth, but its intention is to mislead. The goal is to establish the myth that the wealthy are already paying taxes at such a high rate that it would be unfair to raise their taxes. Chuck Marr and Brian Highsmith provide a nice summary of reality in an article posted on the

Center on Budget and Policy Priorities (CBPP) site:

Misconceptions and Realities About Who Pays Taxes.

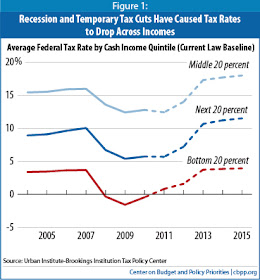

The following chart indicates that the past few years were anomalous in terms of tax rates.

"In a typical year, roughly 35-40 percent of households have no net federal income liability; in 2007, the figure was 37.9 percent. In 2009, however, two factors combined to cause a large, temporary spike in the share of Americans with no net federal income tax liability — the recession, which reduced many people’s incomes, and several temporary tax cuts that have now expired. The 51 percent figure reflects these temporary factors."

One should note that those included in the group with no income tax liability are students, the disabled, seniors living on social security, and wage earners whose incomes are pathetically low.

The claim that no income taxes are being paid is meant to imply that no federal taxes of any kind are being paid. That is just not true. Anyone who works or buys gasoline, for example, is paying federal taxes. The following chart captures the majority of these other types of federal taxes.

State and local taxes are not insignificant and they tend to be regressive. The following chart averages over the 50 states.

The authors provide this enlightening summary:

"Considering all taxes — federal, state, and local — the bottom 20 percent of households paid an average of just over 16 percent of their incomes in taxes (12.3 percent in state and local taxes plus 3.9 percent in federal taxes) in 2009. The next 20 percent paid about 21 percent of income in taxes, on average."

"In fact, when all taxes are considered, the share of taxes that each fifth of households pays is similar to its share of the nation’s total income. The tax system as a whole is only mildly progressive."

The tax system as a whole is only mildly progressive! I had never seen taxes, in their entirety, broken out in this manner. Thanks to the authors and CBPP for this burst of illumination.

No comments:

Post a Comment